99exch Review: Comprehensive Look at India’s Emerging Trading Platform, Partnerships, and Future Outlook

India’s digital finance landscape is evolving at a breakneck speed, and a new contender, 99exch, is quickly gaining traction among traders, investors, and tech‑savvy users. Positioned as a versatile exchange platform, it promises a blend of cutting‑edge technology, robust security, and an ecosystem that extends beyond traditional trading. In this article we examine the core offerings of 99exch, assess its partnership strategy—including collaborations with redddybook and cricbet99—and highlight the roadmap that could shape its role in the Indian market.

What Is 99exch?

99exch is an Indian‑registered digital exchange that supports multiple asset classes, from cryptocurrencies and tokenized securities to traditional commodities. Launched in 2022, the platform aims to democratize access to sophisticated trading tools while maintaining compliance with the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) regulations.

Core Features That Differentiate the Platform

- Multi‑Asset Dashboard: Users can monitor and trade a diverse portfolio from a single interface, reducing the need for multiple accounts.

- Advanced Charting & AI‑Driven Insights: Real‑time analytics and machine‑learning models provide predictive signals, helping both beginners and seasoned traders.

- Low‑Cost Fee Structure: Tiered fees based on volume encourage high‑frequency trading without eroding profit margins.

- Liquidity Pools & Staking Opportunities: The platform offers liquidity mining programs that reward participants with native tokens.

Security and Regulatory Compliance

Security remains the paramount concern for any exchange. 99exch employs a multi‑layered security architecture that includes:

- Cold Storage: Over 95% of user funds are stored offline, isolated from internet‑connected servers.

- Two‑Factor Authentication (2FA) & Biometric Log‑ins: These safeguard account access across devices.

- Regulatory Audits: Quarterly audits are conducted by third‑party firms to verify KYC/AML compliance.

Additionally, the platform has obtained a Digital Asset Exchange License from the RBI, positioning it as a compliant gateway for Indian investors.

User Experience: Design Meets Functionality

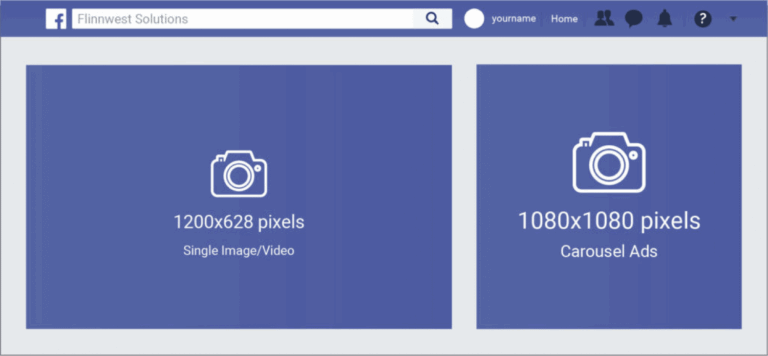

The UI/UX team behind 99exch prioritized simplicity without sacrificing depth. Key UX highlights include:

- Customizable workspace panels for charting, order book, and news feeds.

- A mobile app (iOS & Android) that mirrors desktop functionality, facilitating on‑the‑go trading.

- Educational sections featuring webinars, tutorials, and a community forum.

Strategic Partnerships: Extending the Ecosystem

Recognizing that a trading platform thrives in a broader digital ecosystem, 99exch has forged alliances with complementary brands.

Collaboration with redddybook

redddybook operates as a literary community, offering curated book clubs and author events across India. The partnership integrates a “knowledge hub” within 99exch, where users can access curated reading lists on finance, behavioral economics, and market psychology. This synergy nurtures informed trading decisions, bridging the gap between education and execution.

Synergy with cricbet99

In a unique cross‑industry move, 99exch partnered with cricbet99, a leading sports‑betting platform focused on cricket. The collaboration introduces a “rewards bridge” where users can convert staking rewards from 99exch into betting credits on cricbet99. This model incentivizes liquidity provision while offering an entertaining outlet for earnings, all within a regulated framework.

Future Outlook: Roadmap and Innovation

Looking ahead, 99exch has outlined a three‑phase roadmap:

- Phase 1 – Expansion of Asset Classes: Incorporation of tokenized real‑estate and fractional equity shares by Q4 2024.

- Phase 2 – Decentralized Finance (DeFi) Integration: Launch of a hybrid DEX module that enables permissioned smart contracts while retaining KYC compliance.

- Phase 3 – AI‑Powered Portfolio Manager: A fully automated robo‑advisor that rebalances portfolios based on risk tolerance and market signals, slated for early 2025.

Additionally, the platform plans to deepen its community ties by hosting joint events with redddybook and launching seasonal contests with cricbet99. These initiatives aim to cement brand loyalty and drive organic growth.

Conclusion

In a market saturated with global giants, 99exch distinguishes itself through a balanced focus on security, multi‑asset flexibility, and strategic partnerships that extend the user experience beyond pure trading. By integrating educational resources from redddybook and innovative cross‑rewards with cricbet99, the platform cultivates a holistic digital ecosystem tailored to Indian investors. As regulatory clarity improves and the platform rolls out its ambitious roadmap, 99exch is poised to become a central hub for next‑generation finance in India.